If you work at a Canadian technology company, there’s a high probability your company qualifies for SR&ED tax credits. Not “maybe.” Probably.

The CRA doesn’t require you to be a certain size, or to have a certain amount of funding, or to be in a specific industry. They just require that you do R&D work in Canada and document it properly. Most tech companies meet these criteria.

The Three Basic Requirements

To claim SR&ED, three things must be true:

- You’re a Canadian-resident corporation. Incorporated federally or provincially in Canada, or operating a Canadian branch.

- You conduct SR&ED work. Your company does development work where you face technological uncertainty and investigate systematically to achieve advancement.

- You do this work in Canada. The research must happen in Canada.

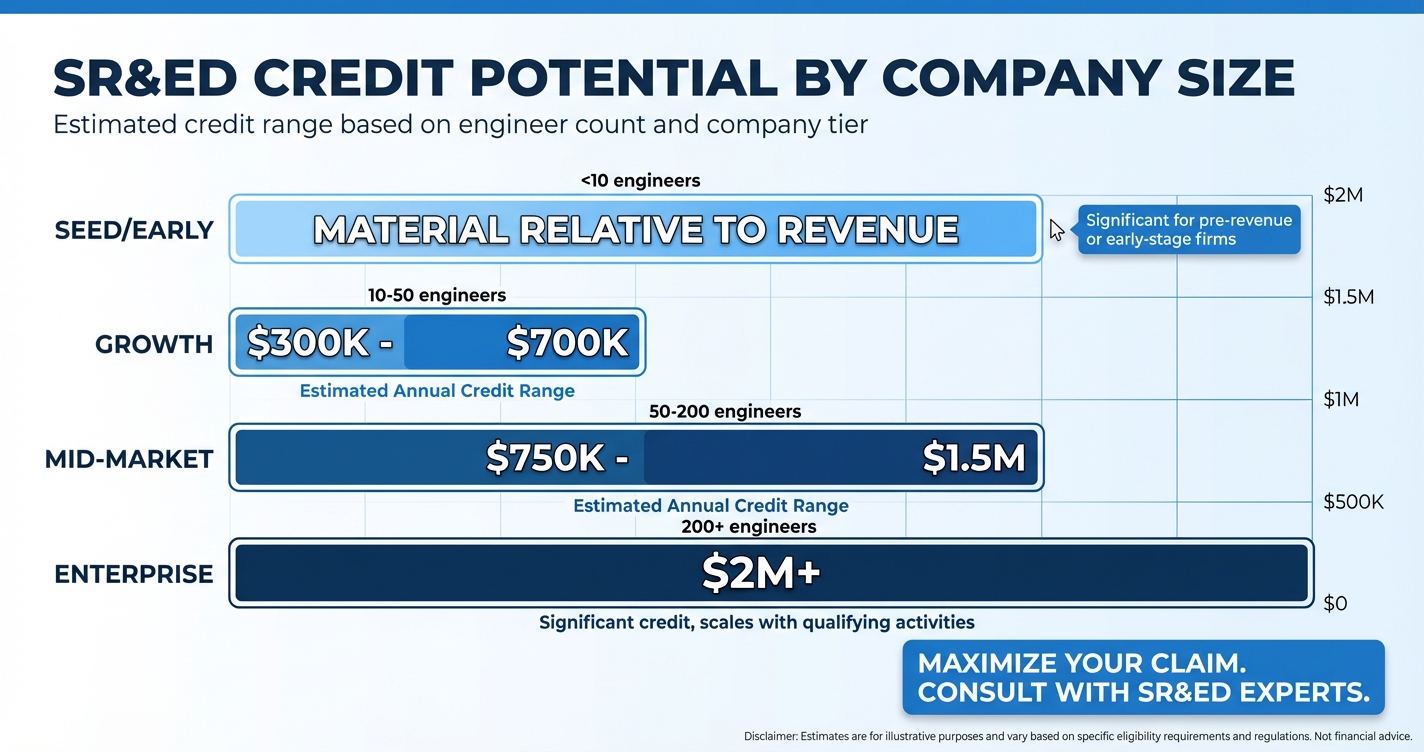

By Company Size

Seed/Early Stage (Less than 10 engineers): Almost certainly yes, if you’re doing real R&D work. The credit can be substantial relative to your revenue.

Growth Stage (10-50 engineers): Definitely yes. Annual engineering spend of $2M–$5M puts credits at $300K–$700K.

Mid-Market (50-200 engineers): Yes. Engineering spend of $5M+ means credits could be $750K–$1.5M annually.

Enterprise (200+ engineers): Yes. Credits could be $2M+.

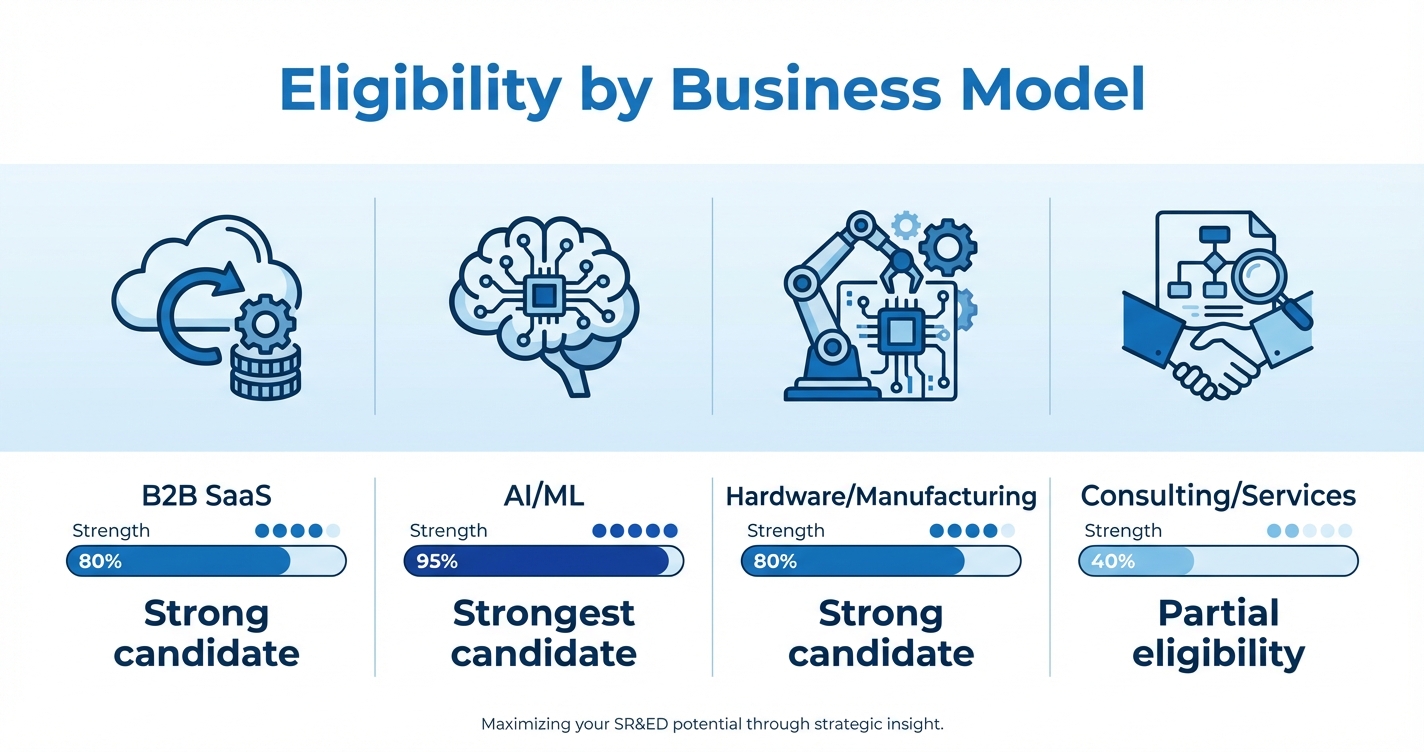

By Business Model

B2B SaaS: Strong candidates. You’re developing technology, facing technical challenges continuously.

AI/ML: Strongest candidates. Almost pure R&D work.

Hardware/Manufacturing: Strong candidates, especially with recent capital expenditure changes.

Consulting/Services: Partially eligible if you develop proprietary IP.

Key Point

The real question isn’t “do we qualify?” It’s “why haven’t we claimed yet?”

If you think you qualify, your next step is understanding whether the credit is material to your business. Do the math: Annual engineering spend × 30-40% × 15-35% = potential annual credit. If that number is $50K+, it’s worth your attention.