If you Google “R&D tax credits Canada,” you’ll find hundreds of pages explaining the same thing in increasingly complex ways.

This isn’t that guide. This is for people who’ve never heard of SR&ED, don’t understand why it matters, and want to know if it applies to them without wading through CRA publication 4900.

What Are R&D Tax Credits?

R&D tax credits are government incentives that refund or reduce your taxes based on the R&D work your company does. In Canada, the main program is called SR&ED—Scientific Research and Experimental Development.

Here’s the basic formula: You do R&D work → You document it → You file a claim with the CRA → You get money back.

The “money back” part is the incentive. The government is trying to encourage companies to invest in innovation. Instead of doing that through grants (which are competitive and selective), they use tax credits (which are available to any company that meets the criteria).

Why Does It Exist?

Canada’s economy depends on innovation. But innovation is expensive and risky. If a company has to choose between investing the money in R&D or returning it to shareholders, the incentive to do R&D decreases.

The SR&ED program says: “If you invest in R&D, we’ll give you some of that money back through tax credits.” This shifts the math. Now the company’s net cost of R&D is lower, making the investment more attractive.

From a company’s perspective: R&D is an investment in your future. The SR&ED credit makes that investment more affordable.

Who Can Claim?

Three conditions:

- You’re a Canadian-resident corporation. This includes federal and provincial corporations operating in Canada. If you’re a sole proprietor or partnership, you can claim, but the mechanics differ slightly.

- You conduct R&D work. This means solving technical problems where the solution wasn’t obvious at the start. It doesn’t mean you have to invent something new to the world. It means you faced technological uncertainty and had to investigate systematically to resolve it.

- You do this work in Canada. SR&ED work must happen within Canada. If you outsource R&D to an offshore team, that work doesn’t qualify.

Most technology companies meet all three criteria.

What Qualifies?

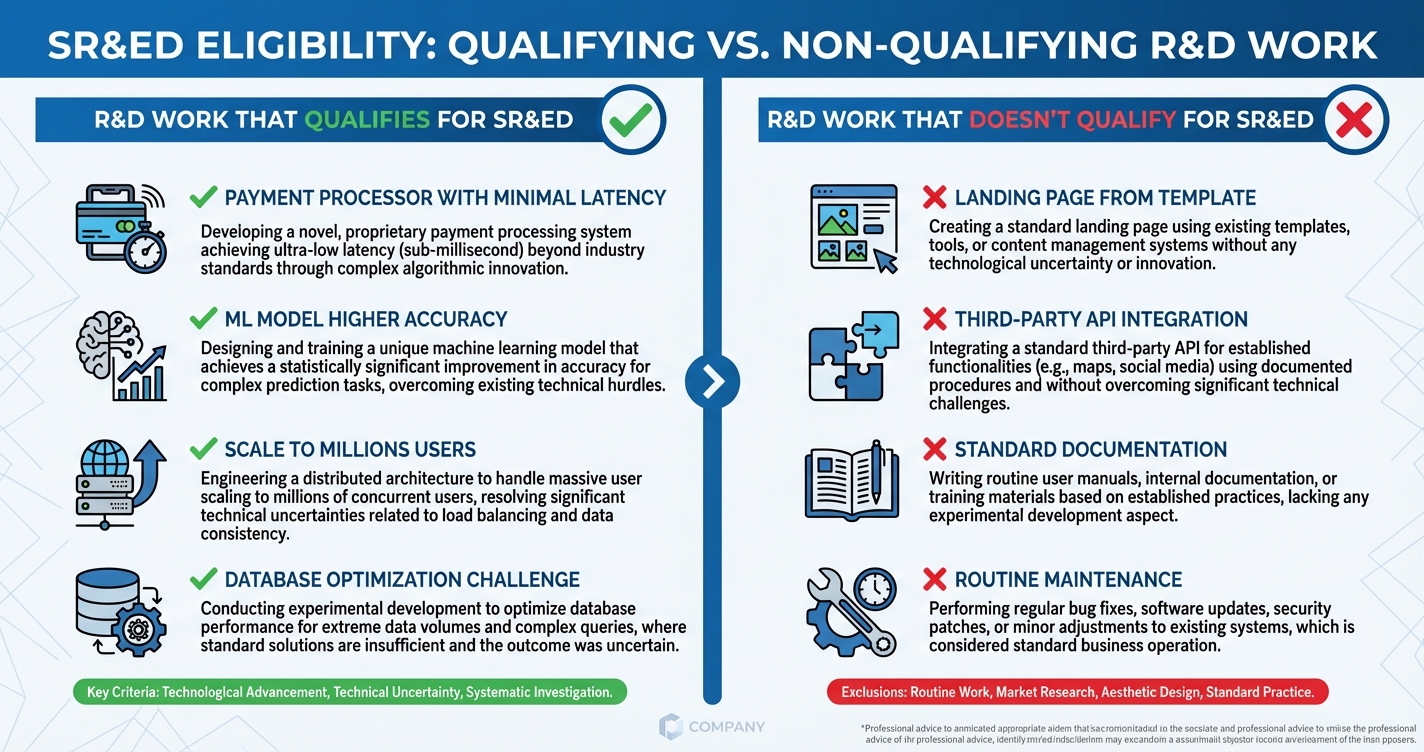

This is where people get confused. The CRA isn’t asking “Is this innovative?” They’re asking “Did you face a technological obstacle and have to figure out how to overcome it?”

Examples that typically qualify:

- Building a payment processor that handles currency conversion with minimal latency

- Developing an algorithm that improves recommendation accuracy beyond existing approaches

- Architecting a system that scales to millions of concurrent users

- Solving a concurrency bug that documentation and standard debugging didn’t solve

- Creating a machine learning model that achieves higher accuracy than existing open-source alternatives

- Optimizing a database query that was becoming a performance bottleneck

Examples that typically don’t qualify:

- Building a landing page from an existing template

- Integrating a third-party API to a standard workflow

- Writing documentation or business logic that has obvious solutions

- Operations and maintenance of existing systems

- Testing and QA that follow standard processes

The dividing line: If the solution is obvious to a competent engineer with access to documentation and Stack Overflow, it probably doesn’t qualify. If the solution required investigation, experimentation, and overcoming genuine technical uncertainty, it probably does.

What Can You Claim?

When you file an SR&ED claim, you’re claiming eligible expenditures. These typically include:

- Salaries and wages for employees who worked on R&D (all-in cost, including benefits)

- Contract costs if you paid other companies or freelancers to do R&D work

- Materials and supplies directly used in R&D

- Equipment and machinery used in R&D (newly restored in 2025 under Budget 2025 changes)

- Overhead allocable to R&D activities (typically 65% of direct salary costs)

You can’t claim:

- Marketing and sales costs

- General administrative overhead unrelated to R&D

- Costs of work that doesn’t qualify as SR&ED (like building the standard landing page)

How Much Can You Get Back?

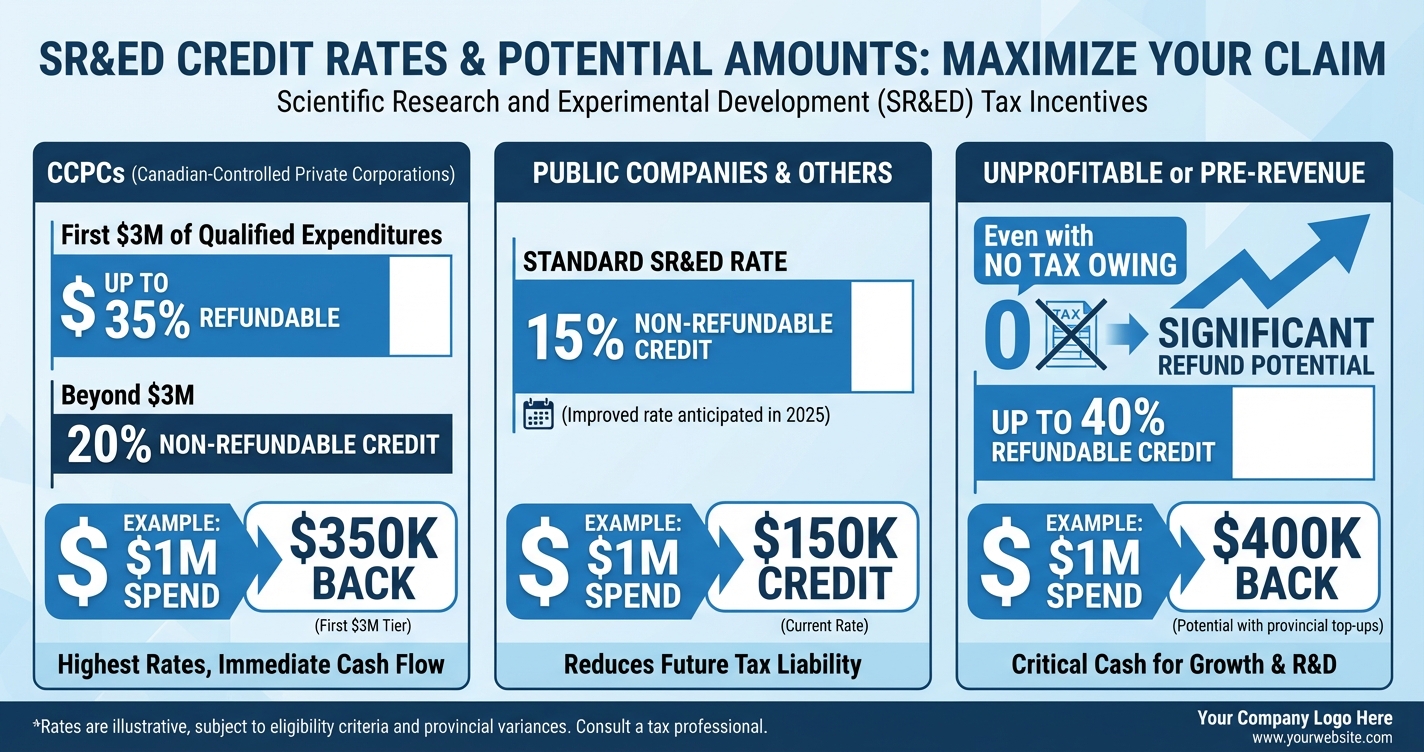

This depends on your company’s structure and profitability:

For profitable Canadian-controlled private corporations (CCPCs):

- First $3 million of eligible expenditures: up to 35% back (refundable)

- Beyond $3 million: 20% (non-refundable, applies against tax owing)

For larger companies or public corporations:

- 15% (non-refundable)

- This changed in 2025—public companies now get access to some of the better rates

For unprofitable companies:

- You can still get a refund (up to 40% in some provinces), even if you owe no tax

The math: If you spent $1M on R&D and you’re a CCPC with under $3M in claimed expenditures, you could get back $350K in refundable credits.

How Do You File?

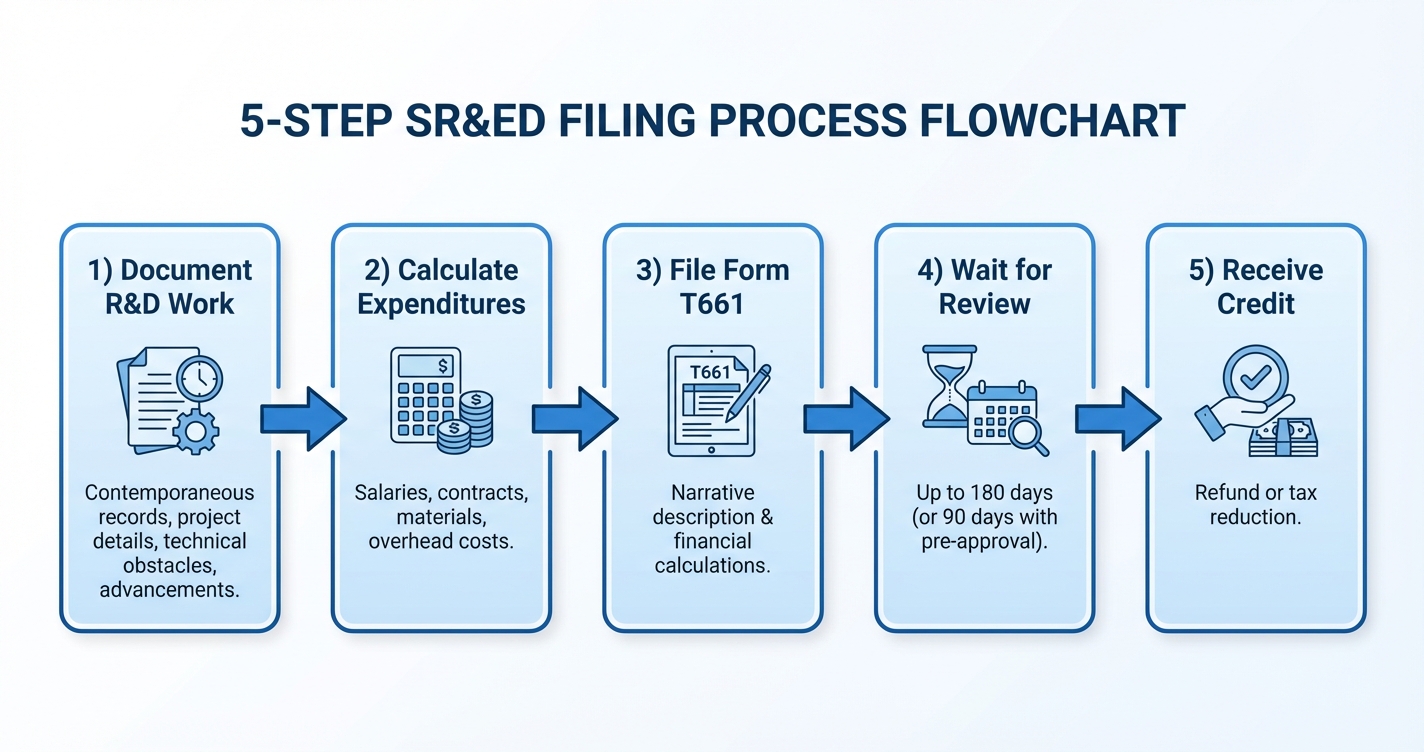

The process has several steps:

- Document your R&D work. You need contemporaneous records (dated, specific, showing SR&ED vs. non-SR&ED time) for the fiscal year.

- Calculate eligible expenditures. Add up all the salaries, contract costs, materials, and overhead for work that qualifies.

- File Form T661. This is the claim form you submit to the CRA. It includes a narrative describing your R&D work and the detailed calculations.

- Wait for review. The CRA typically takes 180 days to review (90 days if you use the new pre-claim approval process launching April 2026).

- Receive your credit. If approved, you get either a refund (if the credit exceeds your tax owing) or a reduction in taxes owed.

Most companies use either a consultant ($20K–$50K per year) or an accountant familiar with SR&ED to handle this process. Increasingly, companies are using software that automates the documentation and calculation steps.

The Documentation Challenge

Here’s why many companies don’t claim: documentation is painful.

Your engineers aren’t naturally tracking SR&ED time. Finance doesn’t have a process for it. So at tax time, you’re trying to reconstruct months of work from memory, commit logs, and conversation history.

This is what consultants charge for—reconstructing your work and filling out the CRA form.

If you document continuously (capturing SR&ED work as it happens), two things change: (1) the claim is more complete and defensible, and (2) you don’t need to hire someone to reconstruct everything.

This is where the automation trend is heading. Tools now integrate with GitHub, Jira, and Slack to capture eligible work automatically.

The Current State of the Program

As of January 2026:

- Budget 2025 changes are in effect, expanding eligibility and refund rates

- The CRA is increasing use of AI to review claims (which means your documentation needs to be clear and rigorous)

- An optional pre-claim approval process is launching April 1, 2026

- Most companies are still under-claiming due to documentation friction

This is actually good news. It means there’s an opportunity. If you start documenting rigorously and file claims, you’ll be ahead of most competitors.

What to Do Next

If you’re curious whether this applies to your company:

- Talk to your engineering leadership. Ask: “In the past year, what technical problems did we solve where the solution wasn’t obvious at the start?” If they can point to multiple examples, you almost certainly have eligible work.

- Get a rough estimate. Your total engineering spend is a starting point. If you spend $1M+ per year on engineering, the credit is likely material.

- Understand your options. You can file yourself if you’re confident in the documentation, hire a consultant, or use software tooling. Each has different costs.

- Start documenting. Whether you claim this year or not, start capturing R&D work going forward. This will make future claims much easier.

The SR&ED program is real, it’s substantial, and it’s available to you. The only barrier is documentation. Everything else is mechanics.