The 2025 federal budget brought the biggest changes to the SR&ED program in over a decade.

If you’ve been thinking about claiming SR&ED, or if you’ve claimed before, these changes matter. They expand eligibility, increase refund rates, and introduce a faster approval process.

The Three Major Changes

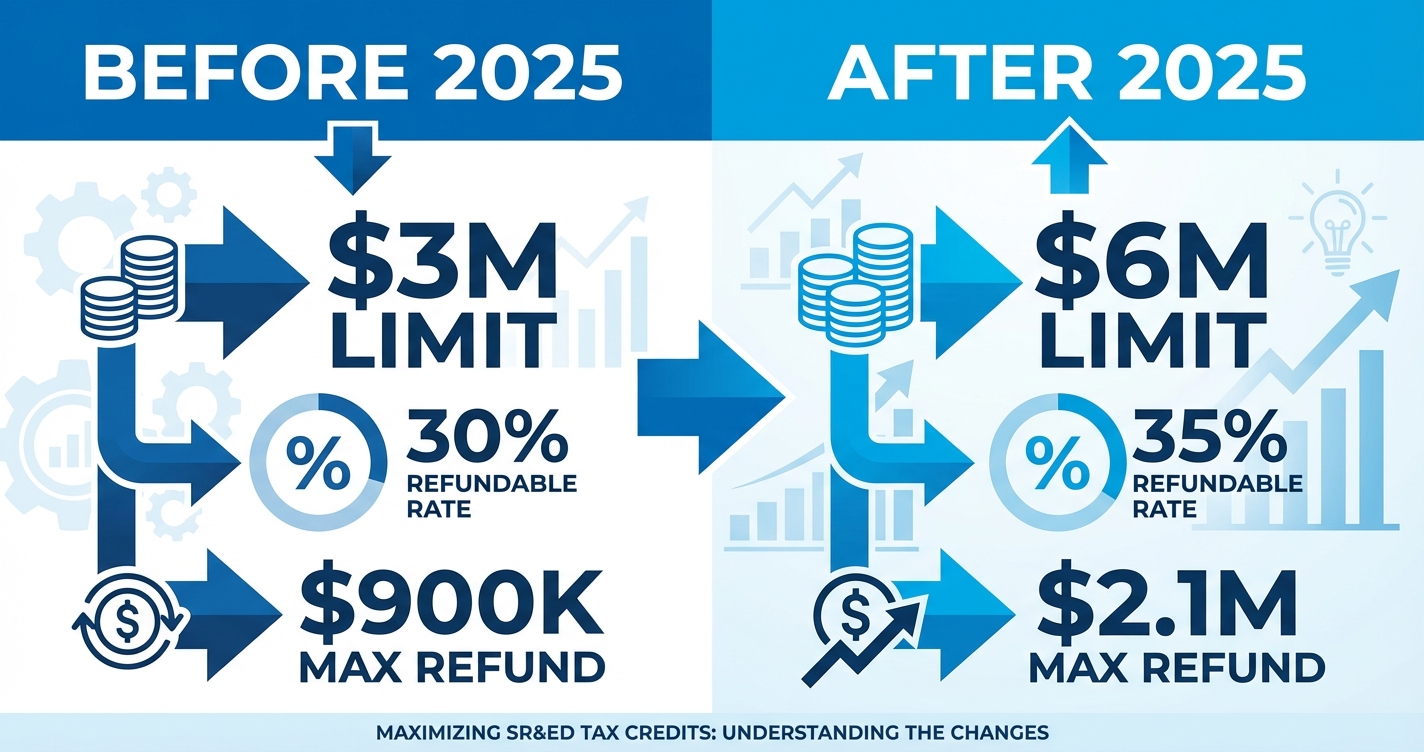

1. The Expenditure Limit Doubled

Before 2025: $3 million per year → 30% refundable = $900K max

After 2025: $6 million per year → 35% refundable = $2.1M max

For a Series B company spending $4M-$6M on engineering, you can now claim expenditures that were previously capped.

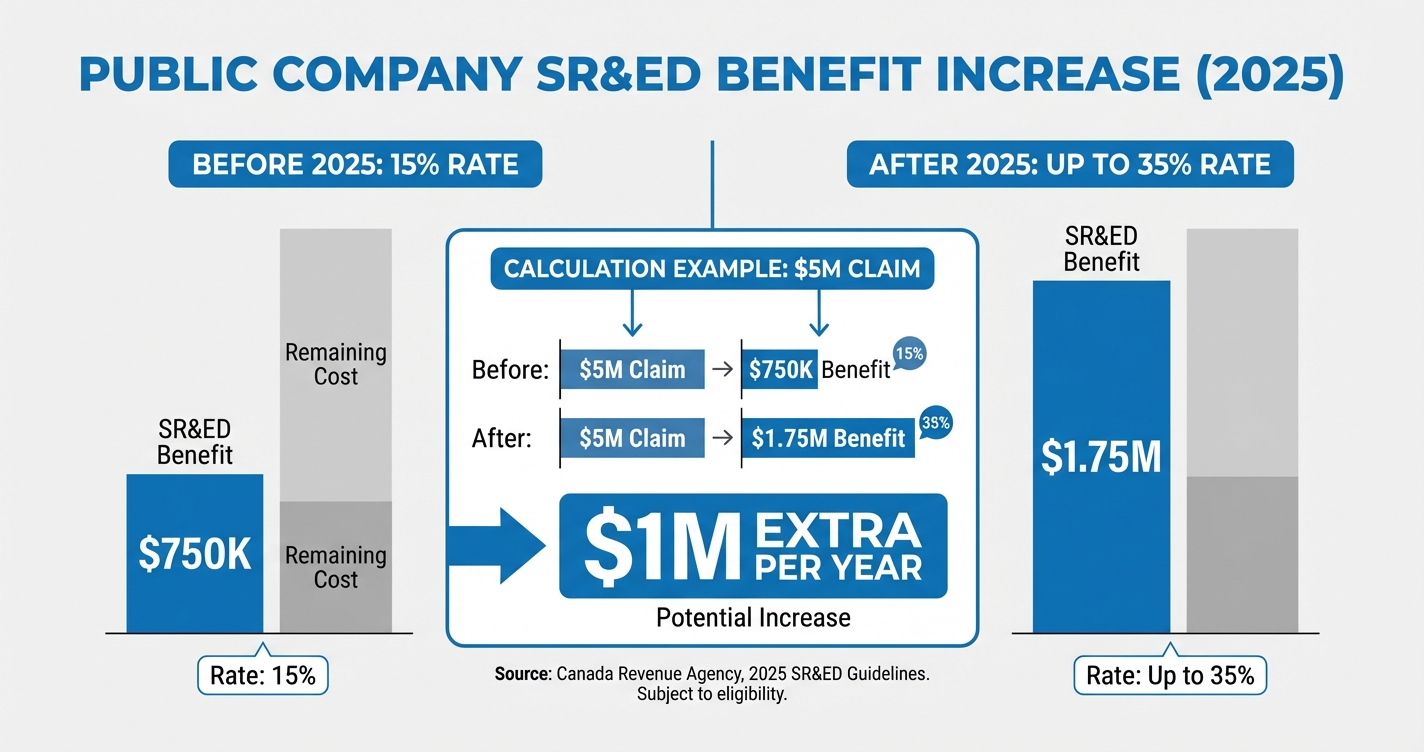

2. Public Companies Can Now Claim

Before 2025: Only CCPCs could claim at 30-35%. Public companies got 15%.

After 2025: Public companies now access up to 35%.

Example: A public tech company claiming $5M now gets $1.75M instead of $750K. That’s an extra $1M per year.

3. Capital Expenditures Are Back

Before 2025: Equipment and facilities didn’t count.

After 2025: Equipment, machinery, and facilities used directly in R&D are eligible.

Impact: Hardware companies, infrastructure-heavy R&D, and AI/ML teams benefit significantly.

Who Benefits Most

- Growth-stage SaaS: Can now claim higher engineering spend

- Public tech companies: Access to better refund rates

- Hardware/infrastructure-heavy companies: Capital expenditure eligibility

- AI/ML companies: GPU purchases and infrastructure now qualify

The Pre-Claim Approval Process

Coming April 1, 2026: Optional process where you submit a pre-claim first. If the CRA pre-approves your approach, full claim is processed in 90 days instead of 180.

What To Do Now

If you’ve never claimed: Get a rough estimate. Consider filing amended returns for past 5 years.

If you’ve claimed before: Talk to your accountant about amending prior returns, especially if you’re public.

If you’re planning to claim: Document carefully, especially capital expenditures.

The Bigger Picture

These changes signal that the CRA is committed to SR&ED. The program is more generous, faster, and more accessible. Document well, claim honestly, and you’ll be fine.