5 SR&ED Eligibility Check Tools Proven to Help Companies File Stronger Claims

Check SR&ED eligibility fast with these smart tools.

You probably already know that validating your claim early can save you time, money, and setbacks during an audit. The problem is that relying on spreadsheets or narrative logs makes it harder to connect your engineering work with SR&ED eligibility requirements.

This leaves finance leaders without the visibility they need for predictable outcomes. At the same time, engineering leaders struggle with the burden of manual tracking. That’s why a fast eligibility check is usually the first step to stronger claims and better financial planning.

In this article, you’ll compare five tools built for that purpose. But first, let’s ground this in what SR&ED actually covers and build from there.

Pro tip: To reduce audit risk and save weeks of manual work, start by running a quick check with Chrono Platform.

What Is SR&ED (Quick Refresher)

SR&ED is Canada’s Scientific Research and Experimental Development program, the largest R&D incentive in the country. Its purpose is to encourage companies like yours to carry out systematic research, experimental development, or applied innovation.

The program does this by reducing the financial risk tied to those activities. You benefit through refundable or non-refundable tax credits applied to wages, subcontractor costs, and other eligible expenses.

The official annual program statistics show its importance. In the 2024-25 fiscal year, the CRA processed a total of 22,738 claims and approved $4.5 billion in investment tax credits. Taken together, those figures show how many companies rely on this incentive.

If you’re more of a visual learner, watch the clip below:

Who Is It For?

The SR&ED program is built for organizations investing heavily in innovation. If you lead a startup or scale-up in software, AI, hardware, biotech, or manufacturing, the program is likely relevant to you. It also supports established SMEs with engineering teams who need to prove the eligibility of work for SR&ED without draining resources on paperwork.

The benefits are clear:

- Access to refundable and non-refundable tax credits.

- Direct refunds that extend your cash runway.

- Lower overall R&D costs by offsetting wages and contractor fees.

- More predictable budgeting for finance leaders.

- A compliance framework that reduces audit exposure.

Understanding what SR&ED covers is just the starting point. Next, let’s discuss the criteria the CRA applies when deciding which projects qualify and why a structured approach matters.

Key Eligibility Criteria (CRA’s 3-Part Test)

The CRA (Canada Revenue Agency) applies three specific tests when reviewing claims. Understanding these upfront helps you avoid wasted time and gives you confidence in your filing strategy.

- Technological uncertainty: The project must address a point where the outcome could not be predicted with standard practices.

- Scientific or technological advancement: The work should push beyond existing knowledge in a measurable way.

- Systematic investigation or experimentation: The project must follow structured methods. It should also be supported by evidence such as technical notes, version history, or test results.

These simple criteria form the backbone of CRA SR&ED eligibility. However, the harsh reality is that misconceptions usually stop teams from even applying.

One common myth is that only “big inventions” or large enterprises qualify.

However, the truth is different. Let’s look at the annual program statistics we cited above.

In the 2024-25 fiscal year, 64% of all claims came from companies with less than $4 million in revenue, while large enterprises filed just 3%. That means early-stage startups are at the center of the program.

Another misconception is that software development rarely qualifies.

Again, the numbers prove otherwise. Software projects accounted for 40.8% of all approved investment tax credits in the same year, which makes it the single largest contributor. If your engineering team faces technical uncertainty when building new systems, integrations, or architectures, that work could be eligible.

So, the biggest challenge in our experience is not understanding the policy.

You want to understand the rules and apply for SR&ED correctly without wasting resources. That’s where fast checks help. In the next section, you’ll see which tools can confirm SR&ED eligibility criteria in Canada quickly and show you where to focus.

The 5 Best SR&ED Eligibility Check Tools

Fast checks save you from wasting effort on projects that don’t qualify. Below are five options you can use to confirm SR&ED eligibility. Compare approaches, and decide which tool best fits your workflow.

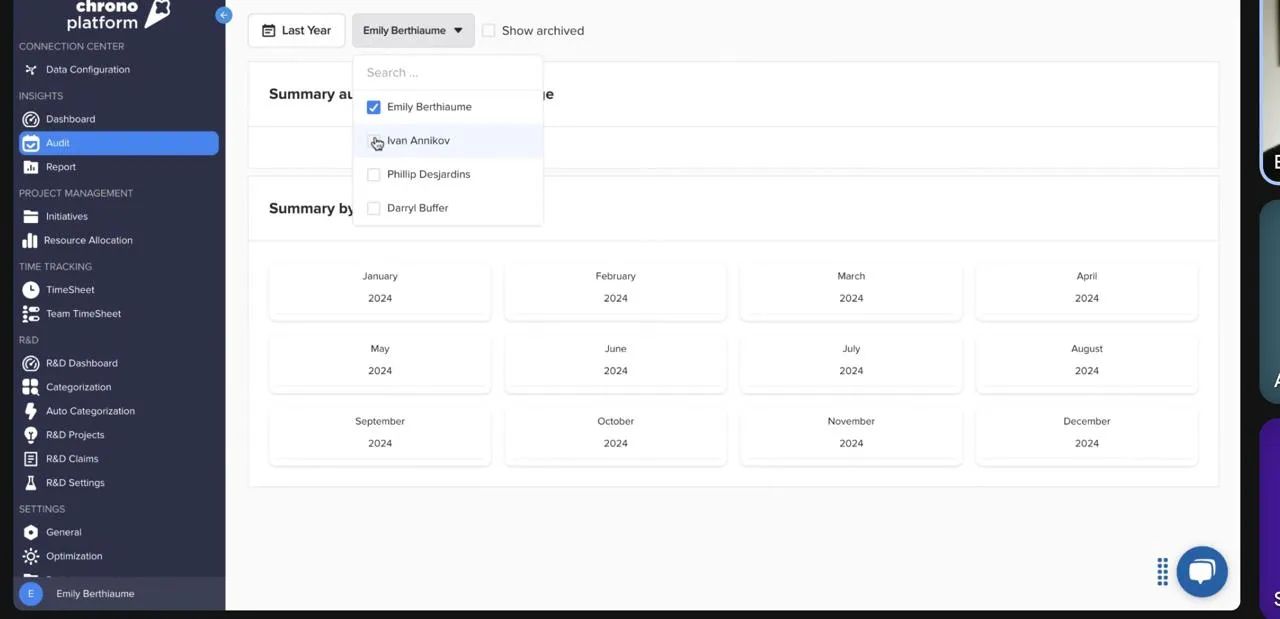

1. Chrono Platform SR&ED Eligibility Tool (Best Overall)

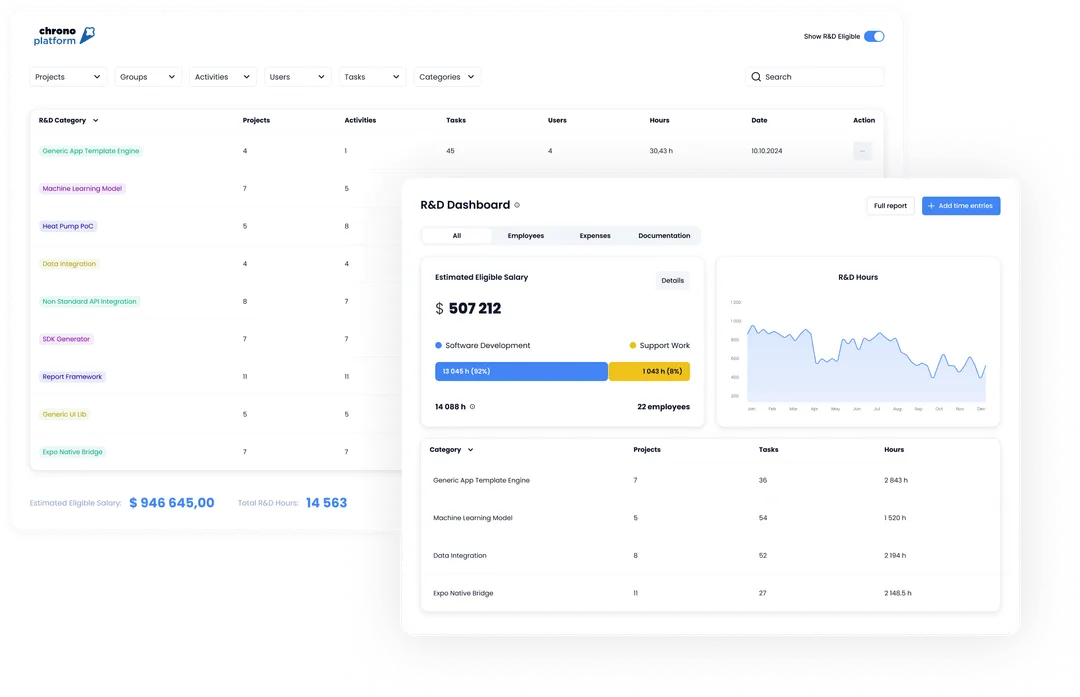

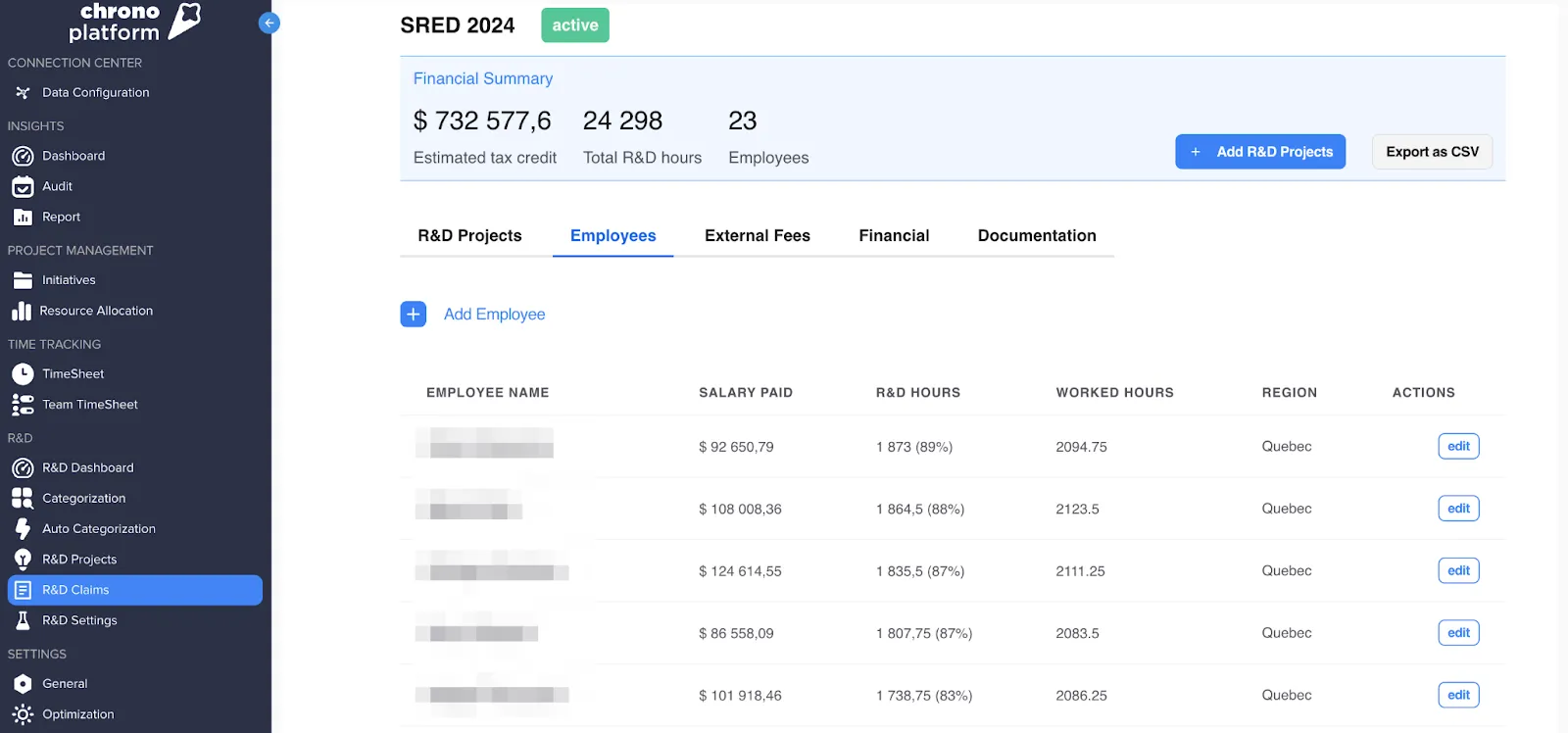

If you want a structured way to confirm SR&ED eligibility without wasting hours on manual spreadsheets, Chrono Platform gives you that advantage. We built our system to automate SR&ED eligibility checks so you can see where your engineering work maps to the CRA’s standards.

You set it up once, connect the tools your teams already use, and we handle the rest. The platform is free for up to three users, which makes it an easy first step before involving external consultants.

Our tool applies AI to your project data and categorizes tasks against SR&ED eligibility criteria. Instead of asking engineers to log time manually, we capture signals from systems such as Jira, Asana, Slack, and Office 365. That data is then normalized and organized into audit-ready records your finance teams can rely on.

And our clients are pleased.

Empego, for example, used to rely on manual time tracking for their SR&ED and CDAE claims. That’s a slow, error-prone process that drained time from their engineering team. With Chrono Platform, they automated it entirely. Our software captured 3,500+ hours in the background, categorized every task in real time, and aligned everything with CRA requirements.

The results speak for themselves:

- $456,000 in eligible salary costs identified

- SR&ED reports completed in just 2 hours

- A 108.78% annualized ROI, driven largely by improved claims and time savings

Chrono gave Empego a clear, reliable SR&ED process, but we also freed their team to focus on actual engineering work.

Unique features include:

- Automatic time tracking that generates pre-filled timesheets.

- Built-in audit rules that align your evidence with CRA expectations.

- Reverse categorization to re-map past project work under updated CRA categories, so you don’t miss eligibility in current or future filings.

- Flexible options so your accountants and consultants can work within the same system.

- An accrual view that shows how much credit you may expect during the fiscal year.

Pros:

- Faster preparation with less effort from engineering teams.

- Greater accuracy because data comes from connected systems.

- Lower audit risk through evidence-based documentation.

Cons:

- Works best for past and current expenses.

- Cannot forecast future projects to check eligibility in advance.

Best for: Chrono Platform is best if you want a clear roadmap to filing. You gain an SR&ED eligibility self-assessment tool that grows with your company. It starts with quick checks and expands into full automation to give both finance and engineering leaders confidence in every claim.

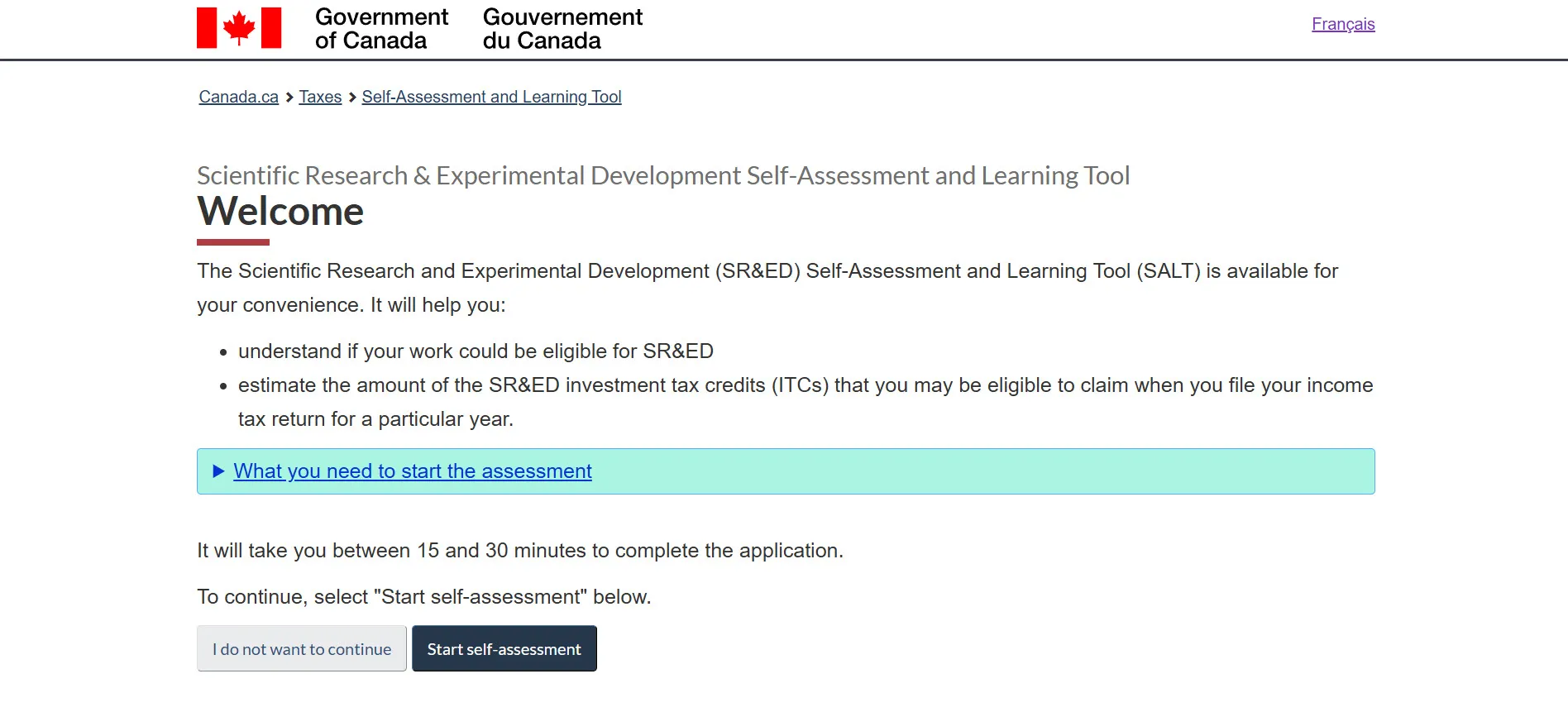

2. Government of Canada SR&ED Self-Assessment Tool

The Government of Canada offers its own Self-Assessment and Learning Tool (SALT) to help you gauge whether your project may qualify for SR&ED tax credit eligibility. This official CRA tool is interactive and web-based, and it gives you a guided set of questions to assess a single project at a time.

To begin, you click “Begin self-assessment” and walk through a questionnaire that asks about your project start date, duration, objectives, and technical challenges. You also need to describe the work you performed, the type of data collected, and any external funding received.

Pros:

- Free to use and backed by the CRA.

- Provides authoritative guidance aligned with official SR&ED eligibility guidelines.

Cons:

- Rigid format that applies the same framework across all industries.

- Requires manual entry of detailed project information, which can take 15-30 minutes per session.

- Designed for one project per session. You must repeat the process for additional projects.

- Results are not binding, so you still need supporting documentation to file a claim.

Best for: This tool is best suited for very early exploration. If you lead finance or engineering teams and want a first impression of how the eligibility of work for SR&ED investment tax credits policy might apply, SALT gives you a structured place to start. However, it won’t replace automation or audit-ready documentation, which are critical once you move past initial checks.

3. Grant-X SR&ED Eligibility Checker

The Grant-X SR&ED Eligibility Checker is built by a consulting and advisory firm that specializes in helping businesses secure funding. It acts as a first-step calculator and guides you through inputs such as salaries, subcontractor costs, and material expenses.

Once you enter your numbers, it produces an estimate of potential tax credits. This gives you a basic sense of where you stand under the SR&ED eligibility policy.

Pros:

- Trusted, with professional backing from an advisory firm.

- Includes case studies that show how companies used the tool as a starting point before consulting experts.

Cons:

- Requires you to manually add all details, which can take time if you lack organized records.

- You must also complete a survey and wait for a reply before moving forward, which slows down the process.

- The estimate is not audit-ready, so you still need expert review to finalize your claim.

Best for: This tool is best for businesses already working with advisory firms such as MNP. If you are accustomed to consultant-driven processes, Grant-X fits as an entry point. It gives you a quick estimate but funnels you toward a traditional review model, where external advisors refine your numbers and documentation.

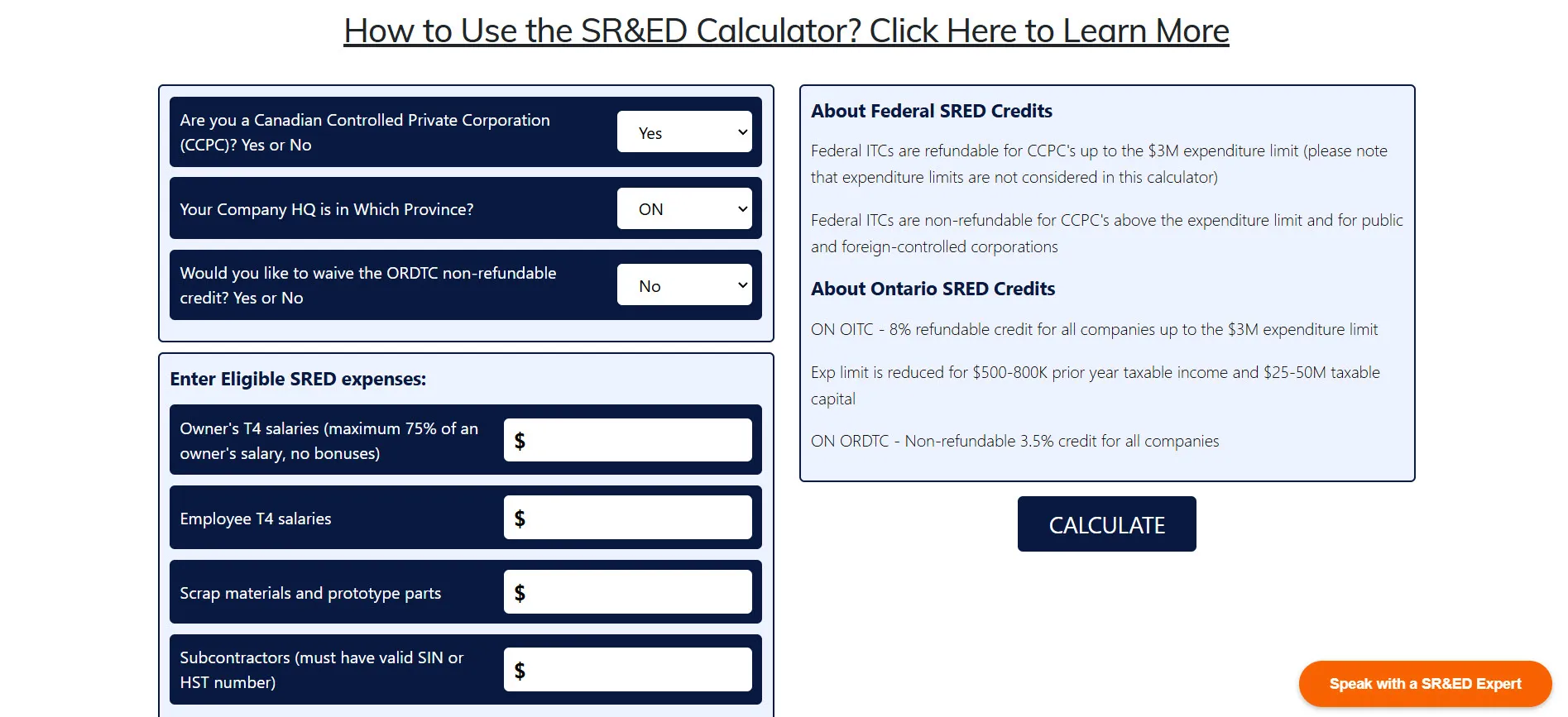

4. G6 Consulting SR&ED Calculator

The G6 Consulting SR&ED Calculator is designed for SMEs that need a simple way to estimate potential tax credits. The tool is web-based and free to use.

You start by confirming if your company is a Canadian-Controlled Private Corporation and then select your province. The calculator adjusts rates automatically to reflect provincial differences, such as Ontario’s refundable and non-refundable SR&ED credits.

Once the setup is done, you manually enter eligible expenses. This includes owner and employee T4 salaries, subcontractor costs, prototype materials, and any government subsidies received during the year.

After clicking “calculate,” the tool generates a rough estimate of federal and provincial credits combined. This gives you a quick sense of how much support your R&D activities might attract under SR&ED statistics eligibility.

Pros:

- User-friendly and straightforward for a first check.

- Backed by a consulting firm, so the framework is credible.

Cons:

- Limited to manual data entry and simple calculations.

- Only scratches the surface because it doesn’t offer audit readiness or integration with your existing systems.

Best for: This calculator works best for small businesses looking for initial guidance. If you want to test assumptions about eligible expenses without committing to a consultant immediately, it serves as a starting point. However, once projects scale or audits become a concern, you’ll need more advanced tools that automate evidence collection and create defensible documentation.

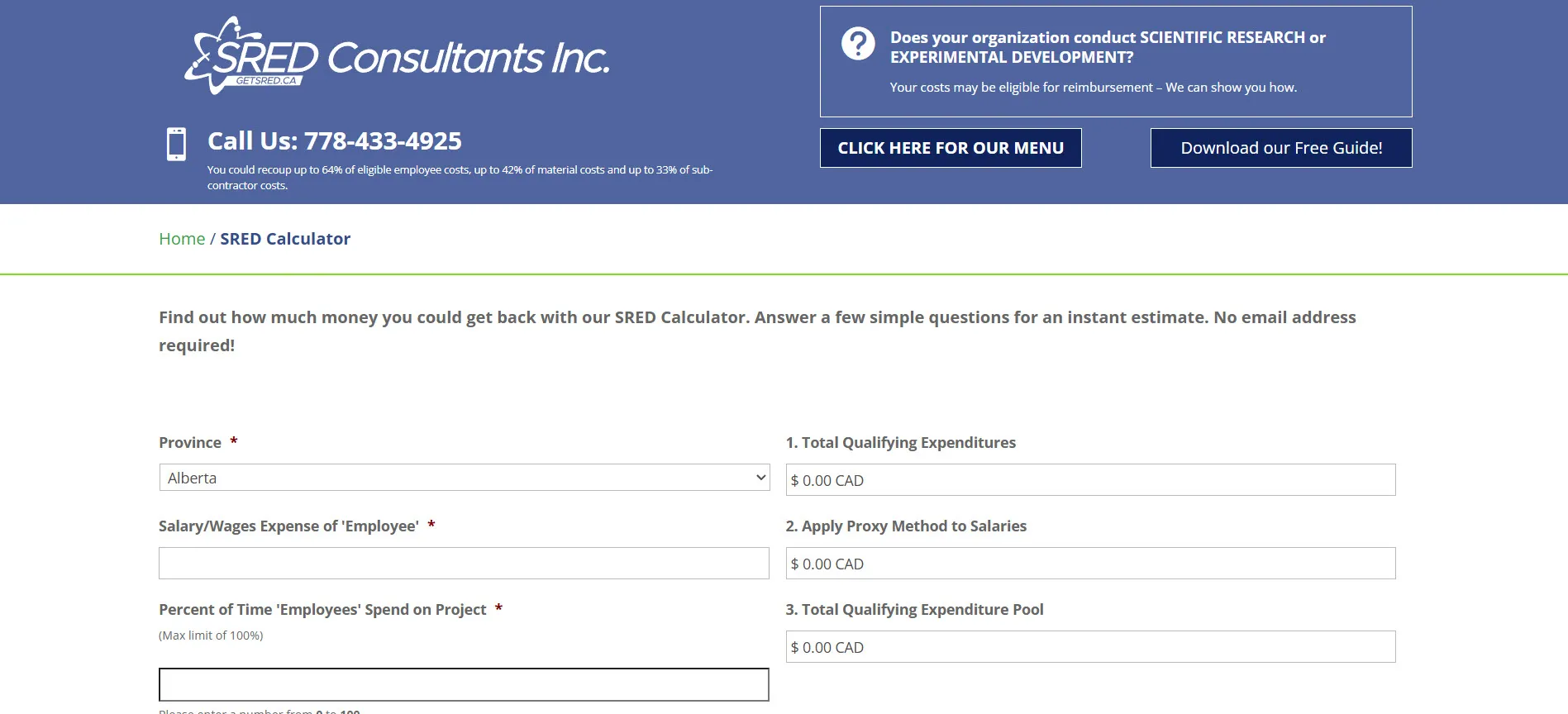

5. SR&ED Consultants Inc. Calculator

The SR&ED Consultants Inc. Calculator is a consultancy-driven tool that gives you a quick estimate of potential credits before you decide to work with an advisor. It is positioned as an entry point.

This means that you enter your company details, project costs, and time allocations, and the calculator generates a projected claim value. The process is simple enough for a rough check, but the real goal is to guide you into a consulting engagement.

Pros:

- Free screening with follow-up advice from SR&ED consultants.

- Includes your province in the calculation, unlike some other calculators that only show federal rates.

Cons:

- You have to manually add every expense, from employee wages to subcontractor fees.

- Some costs may be overlooked if you don’t categorize them correctly.

- Estimates are not audit-ready, so you still need a professional review.

Best for: This calculator is only good if you’re looking for a rough assessment of potential credits. If you want to test assumptions quickly and get a ballpark figure of what your claim might look like, it offers a straightforward path.

However, because the tool is tied directly to consultancy services, it works best if you already plan to involve external experts in your filing process. For finance and engineering leaders who need speed, accuracy, and audit readiness, it remains a basic starting point rather than a complete solution.

How to Use These Tools (and Why Chrono Platform Stands Out)

When choosing the right SR&ED tool, you shouldn’t hurry and aim to just be done with it. A quick estimate can save time, but the real value comes from how you use that information to prepare, plan, and file with confidence.

When you use eligibility tools, a few practices will make the results more reliable:

- Run checks early in the project. If you test eligibility before year-end, you can avoid surprises that can disrupt cash flow planning.

- Compare across tools. Each option gives you a different perspective. Comparing outputs helps you spot gaps and set realistic expectations.

- Gather documentation upfront. Eligibility calculators may point you in the right direction, but claims still depend on organized evidence such as technical notes, project timelines, or cost breakdowns.

Chrono Platform goes further by addressing the limits of calculators and adding features that improve both speed and compliance. Our platform:

- Automatically classifies and reclassifies all work. Instead of relying on your engineers to log time, we pull data from tools you already use and match it against CRA requirements.

- Follows all audit rules. That means you reduce the risk of denied claims and spend less time defending your position if the CRA asks questions.

- Can be used by accountants and finance teams. Everyone works within the same system. This removes the need for multiple versions of the same record.

- Has many more functions beyond SR&ED eligibility checks. From accrual views to reverse categorization, you get both a short-term estimate and a long-term audit-ready roadmap.

The truth is, basic calculators stop at rough estimates. Chrono Platform gives you automation, accuracy, and compliance from day one, which is something no other tool in this space matches.

Take the Next Step with Chrono Platform’s SR&ED Eligibility Tool

Confirming SR&ED eligibility early saves you time, strengthens your audit position, and helps you capture every dollar of tax credit available. Basic calculators can give you rough estimates, but they stop short of real compliance.

Chrono Platform’s automation goes further. It checks eligibility, prepares you for filing with audit-ready documentation, and classifies work automatically. The platform also integrates with the tools your teams already use, so engineers avoid extra tracking and finance leaders gain reliable data.

Start with Chrono Platform today and give your company a faster, clearer path to successful claims.

FAQs

Do these SR&ED eligibility check tools guarantee CRA approval?

No tool can guarantee approval. They help you test how your work aligns with CRA standards, but final acceptance depends on evidence, documentation, and how well your claim addresses the criteria.

How long does it take to check eligibility with an online SR&ED calculator?

Most calculators give you an estimate in 15-30 minutes. The timeline depends on how organized your records are and how much project detail you already have available.

Are SR&ED eligibility check tools free?

Several options are free, including the CRA’s own Self-Assessment and Learning Tool. Others, like Chrono Platform, offer free plans with automation features for small teams before scaling into full use.

What if my project only partially qualifies?

You can still claim credits for the eligible portion. For example, if only part of your development meets CRA’s test for technological advancement, you may recover credits on those costs while excluding routine work.

Can Chrono Platform help me with the claim itself, not just eligibility?

Yes. Chrono Platform automates the entire process beyond eligibility checks. We prepare audit-ready documentation, apply CRA audit rules, and provide accrual views so finance leaders can plan more confidently while engineers avoid extra tracking.